built for

papua new guinea

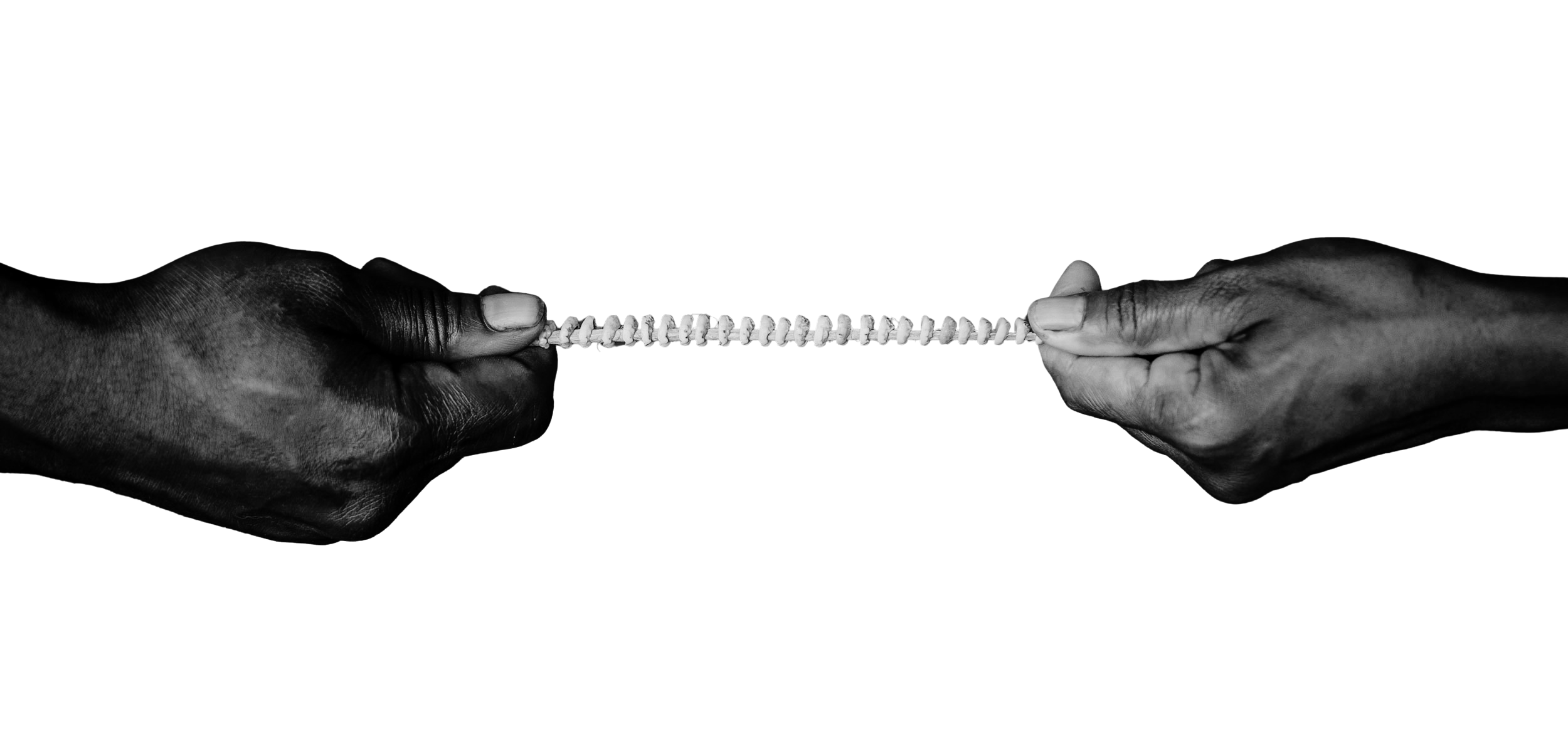

In Papua New Guinea, strength lies in connection. In the systems, people, and principles that hold communities together. At KiVA Financial Crime Advisory, we bring that same philosophy to governance and compliance.

We help organisations build frameworks that meet international standards while reflecting local realities, ensuring their anti-financial crime programs are not only compliant but also credible, resilient, and trusted.

our services

-

A strong anti-financial crime compliance framework begins with a clear understanding of risk.

At KiVA, we conduct targeted and integrated risk assessments across money laundering, terrorism financing, fraud, bribery and corruption, proliferation financing, and sanctions. Whether you require a focused review of a single area (i.e., jurisdictions, products, channels, customers etc.) or a comprehensive assessment of overall exposure, our approach is tailored to your organisation.

All assessments are aligned with international standards such as ISO 31000, ISO 37001, ISO 37003, and FATF (Financial Action Task Force) standards, as well as local Sector Risk Assessments issued by government agencies (for example, Financial Analysis and Supervision Unit - FASU) and regional bodies such as the Asia Pacific Group on Money Laundering.

Our assessments provide a clear view of your risk profile, highlight where controls are effective, and offer practical recommendations to further strengthen alignment between policy and practice.

-

A well-designed anti-financial crime compliance program transforms risk insight into action.

At KiVA, we support organisations to build and strengthen compliance programs that are proportionate, practical, and aligned with both local regulatory obligations and international best practice. Whether developing a new framework or enhancing existing arrangements, each program is tailored to your risk profile, business model, and operating environment.

Our expertise spans the full financial crime program landscape, including money laundering and terrorism financing, fraud prevention, bribery and corruption (including whistleblower frameworks), proliferation financing, and sanctions.

-

An effective anti-financial crime compliance program is more than a framework on paper, it delivers in practice.

At KiVA, we conduct independent reviews of anti-financial crime compliance programs to help organisations meet legislative obligations and ensure that controls operate as intended. Whether preparing for a regulatory inspection, seeking assurance at board level, or strengthening overall effectiveness, our reviews provide clarity and practical direction.

Our assessments consider governance, training, reporting, transaction monitoring, and customer due diligence in practice. The methodology draws on local supervisory expectations as well as international standards such as ISO 31000, ISO 37001, ISO 37003, and FATF (Financial Action Task Force) standards.

Each review is tailored to the organisation’s risk profile and operating context, with clear and sustainable recommendations. The result is confidence that programs are effective, resilient, and aligned with both local and global expectations.

-

Strong anti-financial crime compliance begins with confident people.

At KiVA, we design and deliver tailored training that builds practical, risk-aware capability across every level of an organisation — from frontline teams to senior leaders and board directors. Each session is grounded in local realities, international standards, and real-world case studies, ensuring the content resonates with the environments where people work.

We offer training across the full financial crime landscape, including money laundering and terrorism financing, fraud prevention, bribery and corruption (including whistleblower frameworks), proliferation financing, and sanctions. We also address broader governance themes such as risk culture, ethical leadership, and regulatory engagement.

Our programs range from short workshops and onboarding modules to immersive simulations and board-level briefings. We also support regulators and industry bodies through outreach and awareness programs, helping to strengthen capability across the wider compliance ecosystem.

-

We understand supervision and regulation, and we help others navigate it with clarity, credibility, and care.

At KiVA, we provide both legal and compliance advisory services that support effective engagement between regulated entities and regulators.

Whether preparing for an inspection, demonstrating compliance, interpreting evolving requirements, or managing complex regulatory matters, we help organisations meet their obligations with confidence.

Our partners bring extensive experience in financial crime compliance, governance, and legal risk, enabling us to offer integrated advice across regulatory interpretation, policy alignment, remediation strategy, and stakeholder engagement.

We also work directly with regulators and government bodies, providing capacity building, technical advice, and policy development support. From risk-based supervision models to thematic reviews and enforcement frameworks, we contribute to strengthening the broader regulatory ecosystem in Papua New Guinea.

Who we work with

Your year-round compliance partner.

The Wantok Program

Meet the partners

KiVA is led by two partners with deep and complementary expertise in financial crime risk and the intersection of law, regulation, and governance across Papua New Guinea and Australia.

-

Principal and Co FounderEmmanuel Auru is a legal and governance leader with more than 16 years of experience advising organisations in Papua New Guinea. He holds a Bachelor of Laws from the University of Papua New Guinea and a Master’s in Competition and Consumer Law from the University of Melbourne, Australia.

He has served as Head of Legal and Company Secretary for Papua New Guinea’s oldest commercial bank and as Group Legal Counsel for a Papua New Guinea-based conglomerate listed on the Australian Stock Exchange. His expertise spans regulatory compliance, corporate governance, and financial crime legal frameworks. Emmanuel has advised on regulatory obligations, guided responses to supervisory actions, supported the design and delivery of compliance programs, and managed legal claims and disputes arising from financial crime matters.

He brings a clear understanding of Papua New Guinea’s legal landscape and operational environment, enabling organisations to meet their obligations with clarity, confidence, and accountability.

-

Principal and Co FounderKeeley Jenkinson is a financial crime compliance leader with more than a decade of experience across Australia and Papua New Guinea. She has served in senior leadership positions in the banking sector, including as Money Laundering Reporting Officer for Papua New Guinea’s oldest commercial bank.

She advises boards, engages with regulators, and designs and delivers anti-financial crime compliance programs that are both practical and effective. Her expertise spans the full spectrum of financial crime risks, including money laundering and terrorism financing, fraud, bribery and corruption, whistleblower frameworks, proliferation financing, and sanctions.

Keeley holds a Master’s degree in Fraud and Financial Crime from Charles Sturt University, Australia, and received the Executive Deans Award. She is recognised for combining international standards with local context, using practice-led research to shape governance, risk, and compliance outcomes that are both rigorous and relevant.

“Like a bilum, strong governance is built loop by loop.

Through tension, repetition, and purpose.

And when it’s done right, it is built to carry what matters”.

Contact us.

This form is for general questions, speaking events, or media enquiries. If you’re interested in engaging KiVA for services, such as program reviews, training, or participation in the Wantok Program, please click here.